Melrose PLC (MRO.LN) - Bet on the Jockey

Buy, Improve, Sell - British Turnaround Specialist at a Discount

I recommend a long position in British turnaround specialist Melrose Industries PLC (MRO.LN) at the current price of £1.25. In my base case, the 2023 target price of £2.23 represents ~78% upside.

TLDR: Despite strong operating results, the stock has recently underperformed in the face of the Russia/Ukraine war and the company’s European exposure. I believe this represents an opportunity to pick up shares of a high-quality diversified industrial company with an aligned management team backed by an enviable track record, with exposure to:

The aerospace recovery as narrowbody deliveries ramp

A hidden jewel aero engines business with strong and predictable free cash flows

A strong aerospace defense business with outsized exposure to the F-35

Automotive pent-up demand stemming from semiconductor constraints

Automotive electrification through its leading EV drive system business which features higher content per vehicle

An undemanding valuation with skewed R/R driven by conservative SOTP valuation which will be realized in the next 2-3 years

Hard near-term catalysts, including the divestiture of Ergotron in the next six months and Automotive/Powder Metallurgy in the next 1-2 years

Melrose Industries Company Overview

Melrose Industries is a British turnaround specialist that buys struggling diversified industrial businesses, improves them, and recognizes value through an eventual sale. In essence, they are a publicly traded PE firm. In March 2018, MRO won a hostile takeover of GKN PLC, one of Britain’s oldest businesses, for £8.1B. After the acquisition, MRO operated through five segments: Aerospace (GKN), Automotive (GKN), Powder Metallurgy (GKN), Nortek Air & Security, and Other Industrial. Nortek was acquired in 2016 and has been sold in pieces, with Nortek Air Management recently sold to Madison Industries for £2.8B and Nortek Control sold to Nice for £0.2B, allowing the company to delever to 1.3x. Ergotron remains in MRO’s hands for now, though it will be sold in the next six months.

MRO’s business model is simple and follows a five-step process over a 3-5 year investment horizon: 1) identify underperforming industrial assets, 2) buy at an appropriate price, 3) improve business performance through operational improvements and investments by a chosen, incentivized management team, 4) sell a more profitable and cash-generating asset to a new owner, and 5) return cash to shareholders. Management targets a doubling of their equity investment on companies acquired over the 3-5 year investment horizon and has a track record of exceeding this number.

Bet on the Jockey – “Buy, Improve, Sell”

MRO specializes in acquiring good engineering companies with strong market positions underperforming their potential. Management’s objective when searching for an acquisition is a doubling of shareholders’ investments over 3-5 years. Unlike private equity, Melrose accomplishes this through a laser focus on operations, shunning the excessive use of leverage and financial engineering. Their results have been impressive, with an average equity rate of return of ~29% and a shareholder ROE from 2.2-3.0x. The average ROE across all four exited acquisitions has been 2.6x, and 70% of value created has been through margin expansion versus multiple expansion. Multiple expansion is never assumed by management and the company invests heavily in R&D (£436M spent on Nortek, Elster, and GKN) and capex (average 1.3x depreciation) across its acquired businesses.

Melrose’s investments have, on average, improved margins by ~50% or ~600 bps from pre-acquisition to their eventual sale.

Melrose’s emphasis on margin improvement, rather than sales growth, allows management to focus on situations where it can control the outcome regardless of macro and end market factors. MRO’s management team has operated in the international manufacturing industry for over two decades and provides a platform to streamline corporate structure, rationalize loss-making businesses, invest heavily in R&D and capex, cut unnecessary costs, and incentivize managers based on profitability.

I. Aerospace poised to outperform due to narrowbody ramp and hidden jewel aero engines business

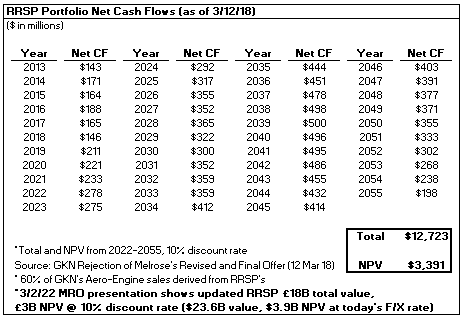

Aerospace is poised to grow in the next five years and beyond, driven by ramp-ups of several key programs. Notably, MRO has high exposures to Airbus’ A320neo and A350, Boeing’s 787 and 737NG/MAX, and Lockheed’s F-35, which combined account for ~49% of all worldwide deliveries ($ amount) over the next 5 years. MRO will be a prime beneficiary of ramping narrowbody production (A320 and 737MAX) with 40% of aerospace sales tied to narrowbodies. More importantly, 60% of GKN’s Aero Engine sales come from Risk Reward Sharing Partnerships (RRSPs), which have a steady and growing free cash flow profile, with a combined £18B net cash flow forecast (£3B NPV) from 2022 to 2067. This is up from the company’s prior disclosure in 2018, which showed a ~£2.5B NPV. GKN is a partner in 70% of all active aircraft engines on the market, and annual net cash flows from the RRSP programs will be ramping from ~£100M in 2022 to ~£300M in 2027. Lastly, Defense represents 34% of Aerospace sales and has prime positioning on the F-35, with ~$2.5M content per aircraft. Any acquirer of GKN Aerospace will have to pay up for these businesses.

Consensus has Aerospace revenues growing at a ~5% CAGR through 2024, which is too low given the company’s portfolio of ramping programs and a doubling of RRSP net cash flows in the next three years. I forecast a ~8% CAGR through 2024 based on current delivery schedules in my base case. On the margin side, the aero engines business historically generated over 13% operating margins (pre-COVID) and most of the aerostructures business had operating margins north of 10%. Management has a 10% margin target when revenues reach 85% of FY19 levels, and 12% at 100% of FY19 levels.

Although Melrose management tends to underpromise and overdeliver, my base case only assumes margins reach 10% in FY24, but I would expect 12% margins with a full aerospace recovery (to 2019 levels) to be the floor, not the ceiling. For reference, Nortek and Elster outperformed their initial margin targets by 2x (initial target was 300 bps of expansion, they achieved 600 bps on each). MRO has also made substantial progress in improving its loss-making North America Aerostructures business, including the recent closure of its unprofitable St. Louis plant. Margins likely have a further 100-200 bps of upside not reflected in my current estimates.

II. Automotive will benefit from pent-up demand and restructuring masked by supply chain shortages

GKN Automotive is well-positioned to improve margins to > 10% with even a partial market recovery over the next three years (sales below 2018 levels). An additional £125-£150M of net cost-takeouts will be realized by year-end 2023 and the full run-rate of the restructured cost base will flow through to margins when supply chain constraints ease.

Given where current auto production levels sit, I see Automotive revenues growing at a ~4% CAGR through 2024 in my base case, which would put revenues at ~87% of 2018 levels. If we slide into a recession, US auto suppliers should be more insulated than in previous downturns due to already depleted inventories which need to be rebuilt. In a non-recessionary scenario, the US is likely under-supplied by > 6M units due to strong pent-up demand stemming from the semi shortage and supply chain constraints throughout 2021. Although Euro SAAR is already tracking at recessionary levels, near-term downside production risks are elevated following the Russia/Ukraine conflict, softening demand, and on-going supply disruptions. That said, at IHS estimated 16.5M units in 2022, production forecasts are already very low. Ultimately, I have less confidence in the near-term inflection of auto given the current uncertainty, but given we are coming off a -22% peak-to-trough decline in global vehicle production from 2017-2020 (vs. -17% from 2007-2009), I expect a gradual recovery to occur through 2024, with possible Euro and APAC weakness offset by relative US strength.

Longer term, GKN Automotive is strongly positioned for the electrification trend and supplies 7 of the top 10 BEV platforms. The company won £5B of new life program contracts in 2021, with BEV’s and full hybrids representing ~50%, and their eDrive business is growing > 2x the market. Their BEV content per vehicle is 4-6x higher than their ICE content per vehicle and is consistent with their stated 10% margin target. With global auto production even slightly recovering from here, GKN Automotive should benefit from strong incremental margins and I wouldn’t be surprised to see margins in the 12% range vs. their 10% target as things normalize. My base case assumes they hit the 10% target in 2024.

III. SOTP points to strong risk/reward with hard near-term catalysts

SOTP valuations sometimes get a bad rap for being impractical or theoretical in nature. That is not the case here. Melrose’s entire purpose is to sell these businesses at a premium once they are properly restructured, and that’s what will happen. I value MRO on a SOTP basis (given all businesses will be sold) on my 2024 EBITDA estimates.

For Aerospace, I believe a 10.5x multiple is conservative given GKN’s defense and higher margin aero engines businesses. Assuming the $3.9B NPV estimate of just the RRSP portion of GKN’s aero engines business represents its true value to an acquirer, a 10.5x EBITDA multiple on the whole Aerospace business implies the remaining portions of the business - civil aerospace structures, the non-RRSP part of the engines business, and defense – are only worth ~7x EBITDA. That’s highly unlikely. For conservatism, I assume a 10.5x EBITDA multiple in my base case, a 12x multiple in my bull case, and a 9x multiple in my bear case.

For the Auto business, U.S. based Dana Inc. (DAN) made a $6.1B (£4.4B at March 2018 exchange rates) offer for GKN’s Driveline business (~61% of Automotive revenue and operating income) before Melrose won the bid for GKN, implying a 7.5x EBITDA multiple at the time. This implies that in my bull case, GKN Auto is only worth slightly more than Dana was willing to pay for just Driveline. Dana also acquired Oerlikon’s drive systems business for 6x EBITDA. Again, for conservatism, I assume a 6.0x EBITDA multiple in my base case, a 6.5x multiple in my bull case, and a 5.5x multiple in my bear case.

The Powder Metallurgy business was one of GKN’s best run businesses and I assume an 8-10x multiple. I assume Ergotron is sold this year in the £400-£700M range (£400 bear/£500 base/£700 bull), implying 7-12x EBITDA.

Putting it all together, the bear case would imply a consolidated EBITDA multiple of 7.1x – which is what GKN traded for before Melrose bought them and restructured the business. Again, I view that is highly unlikely and think the probability distribution is heavily weighted towards MRO being worth much more than the current share price. In summary, we get a high-quality industrial company with an aligned management team at a discounted SOTP valuation whose value will be realized in the next two years, leverage to the aerospace and auto recoveries, and flow-through of margin improvements due to restructuring that was masked due to the pandemic.

Risks

European risk and auto cycle – Automotive and Powder Metallurgy are levered to the auto cycle and have outsized European exposure.

Multiple contraction – If multiples meaningfully contract across all businesses, sales could be completed at lower than projected multiples.

F/X – The company is exposed to USD and EUR fluctuations against the GBP.

Russia/Ukraine – Melrose sources 10M GBP of titanium from Ukraine out of 800M GBP total.

Catalysts

Divestitures - Sale of Ergotron within the next six months and likely divestiture of Auto and/or Powder Metallurgy within the next 1-2 years. Aerospace divestiture or transaction in the next 2-3 years.

Aerospace Investor Day on 6/8/22 – Management will explain “exciting full shareholder value potential” of Engines business and likely give valuation details to help investors properly value the segment.

Large-scale M&A - CEO Simon Peckham has indicated that Melrose may be ready to look for its next large acquisition by the end of 2022.

Insider Buying - There have been several open market insider buys in the past few months.

Business Descriptions

GKN Aerospace (34% of revenues, 30% of operating profit)

Global Tier One aerospace supplier that serves over 90% of the world’s aircraft and engine OEMs. Global #2 in aerostructures and independent aero engine components market and #3 in electrical wiring systems. Aerostructures historically accounted for ~50% of revenues, Engine Systems accounts for ~33%, and Special Technologies accounts for 5%. The business has been pieced together through acquisitions of Filton from Airbus, Volvo Aero (engines) and Fokker.

GKN Automotive (50% of revenues, 46% of operating profit)

Global Tier One supplier of automotive driveline systems and solutions to vehicle manufacturers. Global #1 in driveline (driveshafts) with 47% market share (driveshafts 62% of revenues, propshafts 11% of revenues), all-wheel drive (AWD) with 30% market share (26% of revenues), and eDrive systems with 14% market share (1% of revenues). Supplies 90% of OEMs and 50% of global vehicles.

GKN Powder Metallurgy (13% of revenues, 24% of operating profit)

GKN Powder Metallurgy, which consists of Sinter Metals (83% of revenue) and Hoeganaes Metal Powder (17% of revenue), is the global leader in precision powder metal parts for the automotive and industrial sectors as well as the production of metal powder through its vertically integrated platform. #1 in supply of precision powder metal parts and #2 in powder metal production. Sinter Metals is the world’s leading manufacturer of precision automotive components and components for industrial/consumer applications and Hoeganaes is the world’s second largest manufacturer of metal powder.

Other Industrial (3% of revenues, 14% of operating profit)

“Other Industrial” comprises of Ergotron, which is US #1 in ergonomic mounting and mobility solutions. Ergotron comprises three business segments: Healthcare, Workspace, and Custom.

Appendix (Other)

RRSP Programs and Net Cash Flows

Long-Term Incentive Plan (LTIP)

The LTIP entitles management to 7.5% of the increase in the value of the company (expires May 2023) and is delivered in shares instead of cash. Excluding the LTIP, only two CEO’s earned less than Simon Peckham in 2008, displaying just how aligned MRO’s renumeration policy is with driving shareholder value. Based on the existing policy, the price of MRO needs to hit ~2.70p before management begins to accrue any LTIP. If management hits their target of a doubling of shareholder’s equity in the next 3 years (which it has achieved every time thus far), MRO shares will be trading at ~£3.30.